Challenge Statement

This use case is a small challenge, we are displaying our ability of extracting Data from various types of sources. To facilitate the seamless integration of this Data into a subsequent system, a sequence of discrete tasks necessitates execution, encompassing data filtration in accordance with predetermined criteria, as well as adherence to specific formatting directives. The delineated tasks are as follows:

- Match the ID no. from the total rows to the corresponding detail lines.

- Filter to see only rows with the tax codes P1 or P9.

- Format file type, sort order and field names on the output file.

Note: The tax division of a company has communicated that the essential information is exclusively obtainable within a ‘.TXT’ report format. The expected output format is ‘.XLSX’.

Process

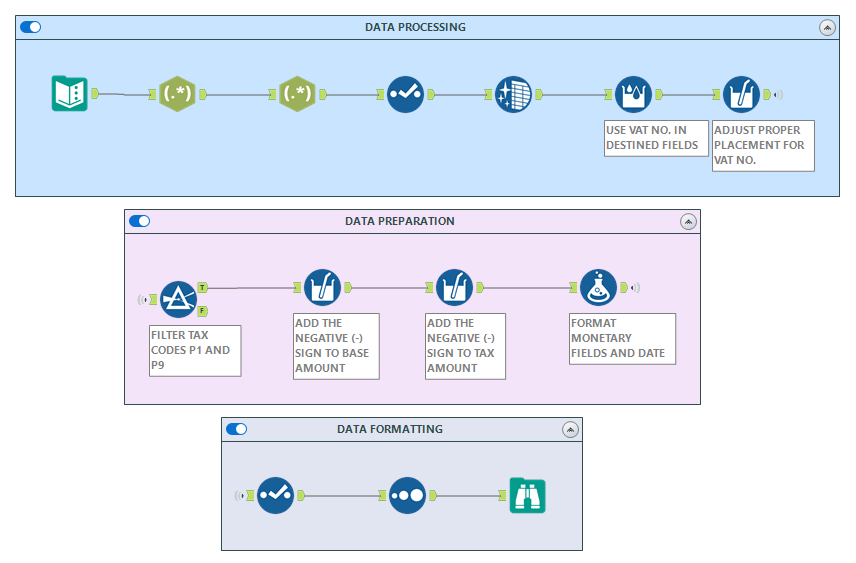

The Alteryx workflow improved data quality and accelerated the prep process:

RegEx and other tools were used to clean the data. The “Vat No.” field had some issues, which were fixed using the Formula Tool. In the prep stage, only P1 and P9 codes were filtered and negative signs were added to show BASE and TAX amounts correctly. The Formula Tool helped format money values. Finally, Select and Sort Tools were used to arrange the data, making it ready to use. Overall, using the workflow, the data was cleaned, prepped, and organized.

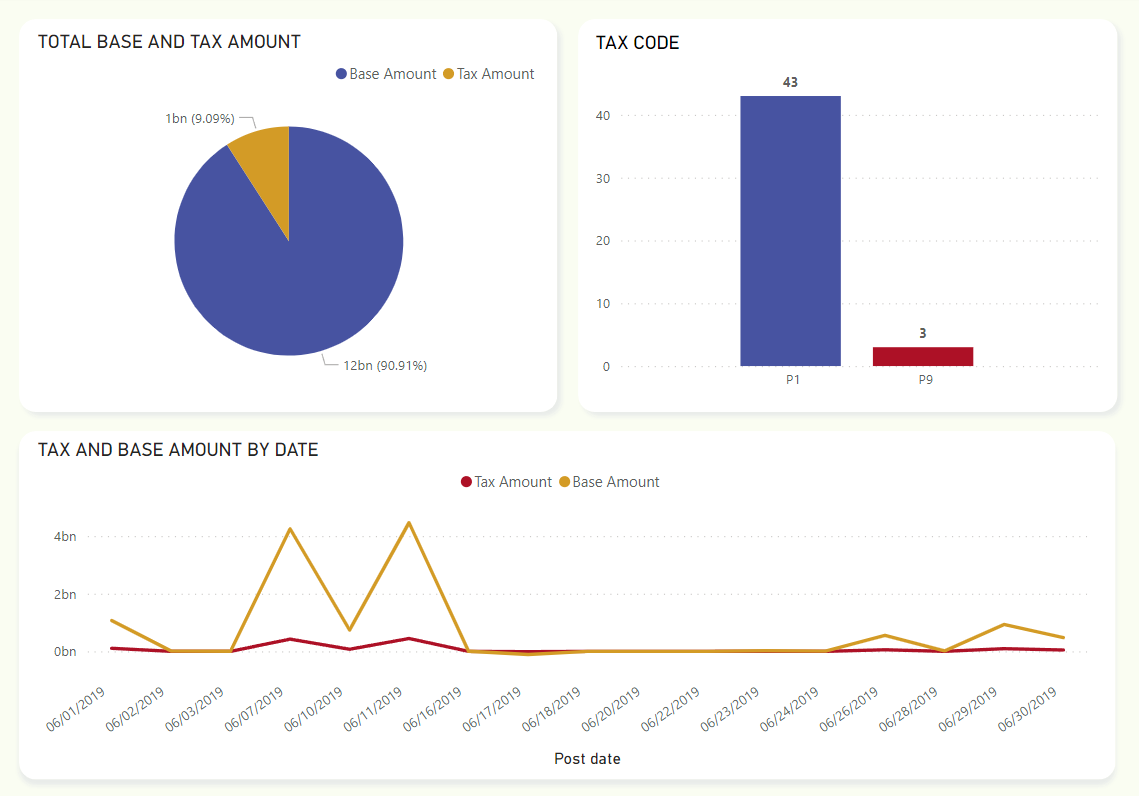

Dashboard

DC LLC

- New York & Boston

- +1 (212) 247 - 5176

- info@d4t4crunch.com

- USA Location

DC Limited

-

6th Floor, 46 Gulshan Avenue,

Gulshan-1, Dhaka-1212, Bangladesh

- +880 17 0638 1806

- info@d4t4crunch.com

- Bangladesh